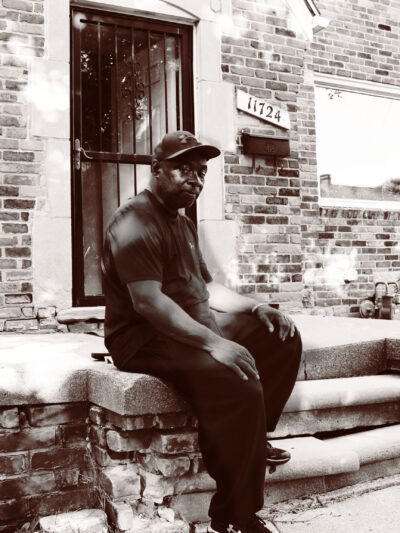

Discriminatory Tax Foreclosures

- Status: Victory!

- Latest Update: Dec 19, 2023

Related News & Podcasts

Jul 03, 2018

ACLU, NAACP Legal Defense Fund Settle Tax Foreclosure Case, Enabling Low-Income Detroiters in Foreclosure to Keep Their Homes for $1,000

Eligible Detroit homeowners must apply immediately to be approved by July 13 deadline to stay in their homes for a cost of $1,000, according to a legal settlement the Detroit City Council approved.

Stay Informed

Sign up to be the first to hear about how to take action.

By completing this form, I agree to receive occasional emails per the terms of the ACLU’s privacy statement.

By completing this form, I agree to receive occasional emails per the terms of the ACLU’s privacy statement.